INFORMATION ABOUT WILLS

WHAT IS A WILL?

Most people know that they should have a will, but many don’t know what a will is and how it works. A will, sometimes called a “last will and testament,” is a document that states your final wishes. It is read by a provincial court after your death, and the court makes sure that your final wishes are carried out.

WHAT A WILL DOES?

Most people use a will to leave instructions about what should happen to their property after they die. However, you can also use a will to:- Name an executor.

- Name guardians for children and their property.

- Decide how debts and taxes will be paid.

- Provide for pets.

- Serve as a backup to a trust.

You shouldn’t try to use a will to:

- Put conditions on your gifts. (I give my house to Susan if she finishes college.)

- Leave instructions for final arrangements.

- Leave property for your pet.

- Make arrangements for money or property that will be left another way. (Property in a trust or property for which you’ve named a pay-on-death beneficiary.)

What Are the Legal Requirements of a Will?

There are very few legal requirements for wills. To make a will in any province you must:

- Know what property you have and what it means to leave it to someone after your death. Legally, this is called having "capacity" and it is also known as being “of sound mind.”

- Create a document that names beneficiaries for at least some of your property.

- Sign the document and date it.

- Have the document signed by two witnesses.

Some provinces require your will to be notarized, although you may use a notarized self-proving affidavit that will make your will easier to get through probate after your death.

A few provinces allow you to make a handwritten “holographic” will, that don’t have to be signed by witnesses. However, handwritten wills should only be used when you do not have time to make a formal will because they are much more susceptible to be challenged after your death.

You can have multiple Wills for your Estate planning

You can have two Wills: primary Will for assets that require probate, and the secondary Will for assets that do not probate (E.g. share of private corporation and personal & household effects). The probate tax will be calculated only on the value of assets administered in the first Will. Both Wills could have similar distribution plans.

In the secondary Will, assets are transferred to the beneficiaries without the need for probate in Canadian provinces. The idea behind multiple Wills is to separate those assets requiring probate from those that do not, to avoid paying probate fees on assets that do not otherwise require it.

*** Please discuss with your lawyer

In the secondary Will, assets are transferred to the beneficiaries without the need for probate in Canadian provinces. The idea behind multiple Wills is to separate those assets requiring probate from those that do not, to avoid paying probate fees on assets that do not otherwise require it.

*** Please discuss with your lawyer

WHY MAKE A WILL?

Your Will is the easiest and most effective way to tell others how you want your property and possessions– called your estate– to be distributed. Even if you don't have much money or property, it's still a good idea to have a Will so that you can name an Executor and make it clear who you want to be make decisions after you death.

FIVE KEY THINGS YOUR WILL SHOULD COVER

- Basic information about you

This includes your name, your address and the date you signed the will. Your will should also state that it is your last will and that it takes the place of any will you made before. - The name of your Executor

An executor is called an estate trustee in most provinces. This is the person you name to carry out your wishes. - Your Executor’s right to manage your estate.

You should give your Executor the right to manage your estate and pay your debts and final costs, such as your mortgage, loan payments, funeral expenses and final income taxes. - How you want your assets distributed

Your will should state who gets what from your savings and property, including your home, investments and cash. It should cover all the things you own, such as cars, furniture, pictures and jewelry. - Guardian(s) for your children

If you have children who depend on you for support, you should name a guardian in case both you and your spouse or partner die at the same time. While your designation is not legally binding, it lets the court know who you want to care for your children. This will likely be factored into the court’s final decision.

WHO SHOULD I NAME AS MY EXECUTOR?

Your Executor (also called your trustee, personal representative or liquidator) is the person you name in your will to be in charge of your property and possessions after your death. Your Executor carries out the instructions you have written in your will. Being an executor can take quite a bit of time and involve a lot of paperwork. If there is no one close to you who can act as your Executor, you might be able to appoint a professional such as a trust company, accountant, lawyer, or the provincial or territorial Public Trustee. If you are thinking about doing this, make sure that the person or organization is willing to take on the job before you name them in your will. Also check to see what their fees will be.

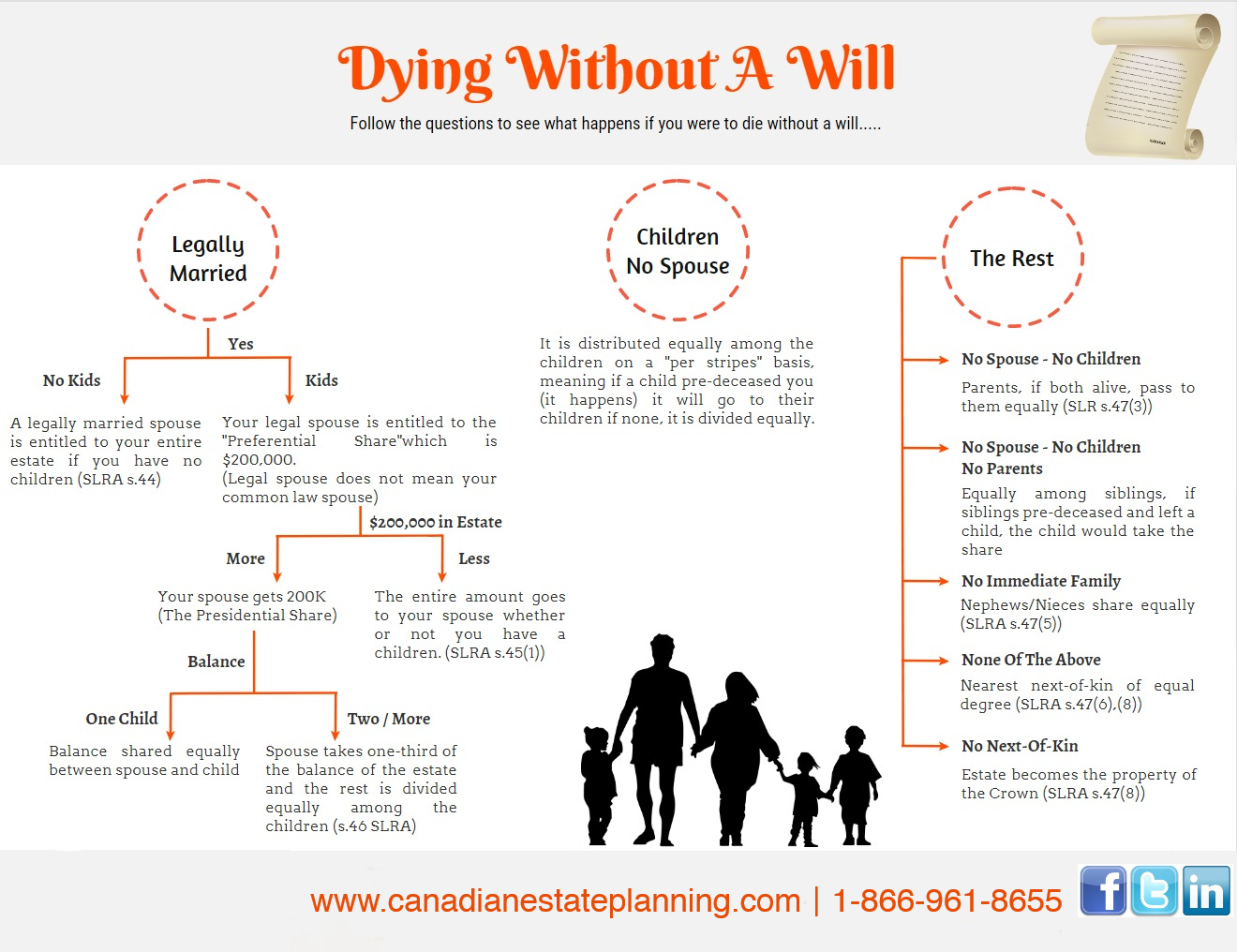

WHAT HAPPENS IF I DON'T MAKE A WILL?

Under the law in most provinces and territories, your nearest relatives are the people who will share in your estate if you die without making a will. Depending on how complicated your estate is, your relatives may need to hire a lawyer and go to court to deal with your estate. Sometimes, a government agency will get involved to make sure that your estate is dealt with properly.

FOUR DISADVANTAGES OF DYING WITHOUT WILL

- The person looking after your estate may not be the one you would have chosen to handle your affairs.

- The provincial distribution formula may not reflect your wishes.

- Your estate may have to pay higher taxes.

- The process of settling your estate will likely be more costly and time consuming.